A swap is an agreement between two parties to exchange sequences of cash flows for a set period of time. Usually, at the time the contract is initiated, at least one of these series of cash flows is determined by a random or uncertain variable, such as an interest rate, foreign exchange rate, equity price, or commodity price.

掉期合约是指交易双方在一段时间内交换现金流序列的协议。 通常,在订立合约时,这些现金流系列中的至少有一个由随机或不确定变量(例如利率,汇率,股票价格或商品价格)决定。

Conceptually, one may view a swap as either a portfolio of forward contracts or as a long position in one bond coupled with a short position in another bond. This article will discuss the two most common and most basic types of swaps: interest rate and currency swaps.

从概念上讲,人们可能会将掉期合约视为远期合约的投资组合,或者视为一种债券的多头头寸与另一种债券的空头头寸相结合。 本文将讨论两种最常见和最基本的掉期类型:利率掉期和货币掉期。

KEY TAKEAWAYS

·In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of one asset for another.

·Of the two cash flows, one value is fixed and one is variable and based on an index price, interest rate, or currency exchange rate.

·Swaps are customized contracts traded in the over-the-counter (OTC) market privately, versus options and futures traded on a public exchange.

·The plain vanilla interest rate and currency swaps are the two most common and basic types of swaps.

要点:

· 在金融学中,掉期合约是一种衍生品合同,其中一方将一种资产的价值或现金流交换或互换为另一种资产。

· 在两种现金流中,一种价值是固定的,另一种价值是可变的,并基于指数价格,利率或货币汇率。

· 掉期合约是在场外交易市场私下交易的定制合约,而不是在公共交易所交易的期权和期货。

· 普通利率掉期和货币掉期是两种最常见和最基本的掉期类型。

The Swaps Market

掉期市场

Unlike most standardized options and futures contracts, swaps are not exchange-traded instruments. Instead, swaps are customized contracts that are traded in the over-the-counter (OTC) market between private parties. Firms and financial institutions dominate the swaps market, with few (if any) individuals ever participating. Because swaps occur on the OTC market, there is always the risk of a counterparty defaulting on the swap.

与大多数标准化期权和期货合约不同,掉期合约不是交易所交易的工具。相反,掉期合约是私人交易方在场外交易市场上交易的定制合约。公司和金融机构主导着掉期交易市场,很少(如有)个人参与其中。因为掉期合约是在场外市场发生的,所以总是存在交易对手违约掉期的风险。

The first interest rate swap occurred between IBM and the World Bank in 1981. However, despite their relative youth, swaps have exploded in popularity. In 1987, the International Swaps and Derivatives Association reported that the swaps market had a total notional value of $865.6 billion. By mid-2006, this figure exceeded $250 trillion, according to the Bank for International Settlements. That's more than 15 times the size of the U.S. public equities market.

第一次利率掉期于1981年发生在IBM和世界银行之间。然而,尽管相对不成熟,掉期的流行程度却激增。1987年,国际掉期和衍生品协会报告称,掉期市场的名义总值为8656亿美元。根据国际清算银行的数据,到2006年年中,这一数字超过了250万亿美元。这是美国公开股票市场规模的15倍以上。

Plain Vanilla Interest Rate Swap

普通利率掉期

The most common and simplest swap is a plain vanilla interest rate swap. In this swap, Party A agrees to pay Party B a predetermined, fixed rate of interest on a notional principal on specific dates for a specified period of time. Concurrently, Party B agrees to make payments based on a floating interest rate to Party A on that same notional principal on the same specified dates for the same specified time period. In a plain vanilla swap, the two cash flows are paid in the same currency. The specified payment dates are called settlement dates, and the times between are called settlement periods. Because swaps are customized contracts, interest payments may be made annually, quarterly, monthly, or at any other interval determined by the parties.

最常见和最简单的掉期是普通的利率掉期交易。在此掉期交易中,甲方同意在特定日期和特定时间内,按名义本金向乙方支付预定的固定利率。同时,乙方同意在相同的规定时间内,在相同的规定日期,以相同的名义本金,按浮动利率向甲方支付款项。在普通的掉期交易中,两种现金流以相同的货币支付。指定的付款日期称为结算日期,两者之间的时间称为结算期间。因为互换是定制的合同,利息支付可以是每年、每季度、每月或双方确定的任何其他时间间隔。

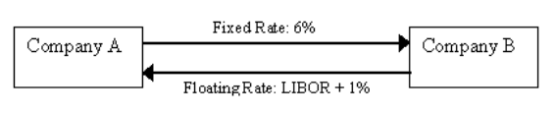

For example, on Dec. 31, 2006, Company A and Company B enter into a five-year swap with the following terms:

·Company A pays Company B an amount equal to 6% per annum on a notional principal of $20 million.

·Company B pays Company A an amount equal to one-year LIBOR + 1% per annum on a notional principal of $20 million.

例如,2006年12月31日,甲公司和乙公司签订了五年期互换协议,条款如下:

·甲公司每年向乙公司支付相当于6%的名义本金2000万美元。

·乙公司向甲公司支付相当于一年伦敦银行同业拆放利率+ 1%的金额,名义本金为2000万美元。

For simplicity, let's assume the two parties exchange payments annually on December 31, beginning in 2007 and concluding in 2011.

为简单起见,假设双方每年12月31日进行汇兑支付,从2007年开始,到2011年结束。

At the end of 2007, Company A will pay Company B $1,200,000 ($20,000,000 * 6%). On Dec. 31, 2006, one-year LIBOR was 5.33%; therefore, Company B will pay Company A $1,266,000 ($20,000,000 * (5.33% + 1%)). In a plain vanilla interest rate swap, the floating rate is usually determined at the beginning of the settlement period. Normally, swap contracts allow for payments to be netted against each other to avoid unnecessary payments. Here, Company B pays $66,000, and Company A pays nothing. At no point does the principal change hands, which is why it is referred to as a "notional" amount. Figure 1 shows the cash flows between the parties, which occur annually (in this example).

2007年底,甲公司将向乙公司支付120万美元(2000万美元* 6%)。2006年12月31日,一年期伦敦银行同业拆放利率为5.33%;因此,乙公司将向甲公司支付1,266,000美元(20,000,000 * (5.33% + 1%))。在普通的利率掉期中,浮动利率通常在结算期开始时确定。通常,掉期合约允许付款相互抵消,以避免不必要的付款。在这里,乙公司支付66,000美元,甲公司不支付任何费用。本金在任何时候都不会转手,这就是为什么它被称为“名义”金额。下图显示了双方之间每年都会发生的现金流(在本例中)。

Plain Vanilla Foreign Currency Swap

普通外币掉期

The plain vanilla currency swap involves exchanging principal and fixed interest payments on a loan in one currency for principal and fixed interest payments on a similar loan in another currency. Unlike an interest rate swap, the parties to a currency swap will exchange principal amounts at the beginning and end of the swap. The two specified principal amounts are set so as to be approximately equal to one another, given the exchange rate at the time the swap is initiated.

普通货币互换涉及将以一种货币支付的贷款本金和固定利息与以另一种货币支付的类似贷款本金和固定利息进行交换。与利率掉期不同,货币掉期的双方将在掉期开始和结束时交换本金金额。设定两个指定的本金金额,以便在给定互换启动时的汇率的情况下,彼此大致相等。

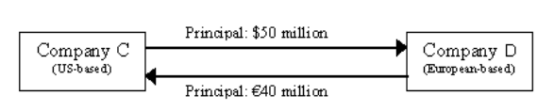

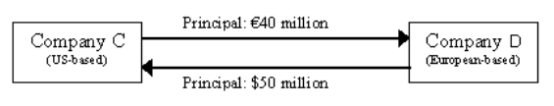

For example, Company C, a U.S. firm, and Company D, a European firm, enter into a five-year currency swap for $50 million. Let's assume the exchange rate at the time is $1.25 per euro (e.g., the dollar is worth 0.80 euro). First, the firms will exchange principals. So, Company C pays $50 million, and Company D pays 40 million euros. This satisfies each company's need for funds denominated in another currency (which is the reason for the swap).

例如,美国丙公司和欧洲丁公司签订了5年期的货币掉期合约,金额为5000万美元。假设当时的汇率是1.25欧元(例如,美元值0.80欧元)。首先,两家公司将交换本金。那么,丙公司支付5000万,丁公司支付4000万欧元,满足了每家公司对以另一种货币计价的资金的需求(这就是掉期交易的原因)。

As with interest rate swaps, the parties will actually net the payments against each other at the then-prevailing exchange rate. If at the one-year mark, the exchange rate is $1.40 per euro, then Company C's payment equals $1,400,000, and Company D's payment would be $4,125,000. In practice, Company D would pay the net difference of $2,725,000 ($4,125,000 – $1,400,000) to Company C. Then, at intervals specified in the swap agreement, the parties will exchange interest payments on their respective principal amounts.

与利率掉期一样,双方实际上将按照当时的现行汇率相互支付款项。如果按一年期计算,汇率为每欧元1.40美元,那么丙公司的付款额为1400000美元,丁公司的付款额为4125000美元。实际上,丁公司将向丙公司支付2725000美元(4125000-1400000美元)的净差额。然后,按照掉期合约规定的时间间隔,双方将交换各自本金的利息。

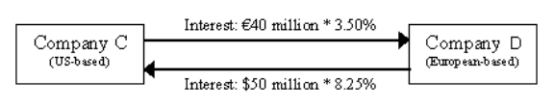

To keep things simple, let's say they make these payments annually, beginning one year from the exchange of principal. Because Company C has borrowed euros, it must pay interest in euros based on a euro interest rate. Likewise, Company D, which borrowed dollars, will pay interest in dollars, based on a dollar interest rate. For this example, let's say the agreed-upon dollar-denominated interest rate is 8.25%, and the euro-denominated interest rate is 3.5%. Thus, each year, Company C pays 1,400,000 euros (40,000,000 euros * 3.5%) to Company D. Company D will pay Company C $4,125,000 ($50,000,000 * 8.25%).

简单来讲,假设他们每年支付这些款项,从本金交换的第一年开始。因为丙公司借入了欧元,所以必须按照欧元利率以欧元支付利息。同样,借入美元的丁公司将根据美元利率支付美元利息。对于这个例子,假设约定的美元计价利率为8.25%,欧元计价利率为3.5%。因此,丙公司每年向丁公司支付1,400,000欧元(40,000,000欧元* 3.5%),公司D将向公司C支付4,125,000美元(50,000,000欧元* 8.25%)。

Finally, at the end of the swap (usually also the date of the final interest payment), the parties re-exchange the original principal amounts. These principal payments are unaffected by exchange rates at the time.

最后,在掉期结束时(通常也是最终利息支付日),双方重新交换原始本金金额。这些本金付款不受当时汇率的影响。

Who Would Use a Swap?

掉期合约的应用

The motivations for using swap contracts fall into two basic categories: commercial needs and comparative advantage. The normal business operations of some firms lead to certain types of interest rate or currency exposures that swaps can alleviate. For example, consider a bank, which pays a floating rate of interest on deposits (e.g., liabilities) and earns a fixed rate of interest on loans (e.g., assets). This mismatch between assets and liabilities can cause tremendous difficulties. The bank could use a fixed-pay swap (pay a fixed rate and receive a floating rate) to convert its fixed-rate assets into floating-rate assets, which would match up well with its floating-rate liabilities.

使用掉期合约的动机分为两个基本类别:商业需求和比较优势。一些公司的正常业务运营导致某些类型的利率或货币风险,互换可以减轻这些风险。例如,一家银行,它对存款(如负债)支付浮动利率,对贷款(如资产)赚取固定利率。这种资产和负债的不匹配会造成巨大的困难。该银行可以使用固定利率掉期(支付固定利率并获得浮动利率)将其固定利率资产转换为浮动利率资产,这将与其浮动利率负债匹配良好。

Some companies have a comparative advantage in acquiring certain types of financing. However, this comparative advantage may not be for the type of financing desired. In this case, the company may acquire the financing for which it has a comparative advantage, then use a swap to convert it to the desired type of financing.

一些公司在获得某些类型的融资方面具有比较优势。然而,这种相对优势可能不适合所需的融资类型。在这种情况下,公司可能会获得其具有比较优势的融资,然后使用掉期将其转换为所需的融资类型。

For example, consider a well-known U.S. firm that wants to expand its operations into Europe, where it is less known. It will likely receive more favorable financing terms in the U.S. By using a currency swap, the firm ends up with the euros it needs to fund its expansion.

例如,一家知名的美国公司,它想将其业务扩展到不太为人所知的欧洲。它可能会在美国获得更优惠的融资条件。通过使用货币掉期,该公司最终将获得扩张所需的欧元。

英文来源:https://www.investopedia.com/articles/optioninvestor/07/swaps.asp